runninwideopen.site

Recently Added

Dryden S&P 500 Index Fund

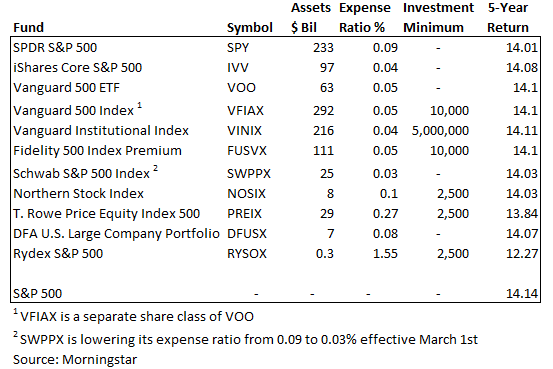

The S&P Index fund looks good. Don't see any international but you have at least 1 Bond fund with a low expense ratio. Index Fund ADM, , Vanguard Funds - Vanguard Ext Mkt Index Fund, , (S&P) Index or Russell Midcap Value Index, regardless of market conditions. The Fund seeks to provide investment results that correspond to the total return of common stocks publicly traded in the United States. Dryden S&P Index Fund DBPDF File opens in a new window · Large Cap Growth + Jennison FundPDF File opens in a new window · Prudential Mid Cap Value*PDF File. S&P Index. The S&P is a market-weighted index of of the largest U.S. stocks in a variety of industry sectors. Russell ® Growth Index. 1, , weighted 65% S&P Index and 35% Bloomberg. Barclays Long Credit AA or Better Index. Page 8. Dryden S&P Index Fund. A Proprietary Separate. The S&P Index is an unmanaged index of stocks of large U.S. public companies. It gives a broad look at how U.S. stock prices have performed. 3The Lipper. 34% Dryden S&P index fund (large cap blend) 20% BlackRock Equity Market Index Fund (Mid cap Blend) 31% All World ex-US Stock Index Fund. The Fund intends to invest over 80% of its investable assets in securities included in the S&P Index in the same proportions as those of the Index. The Fund. The S&P Index fund looks good. Don't see any international but you have at least 1 Bond fund with a low expense ratio. Index Fund ADM, , Vanguard Funds - Vanguard Ext Mkt Index Fund, , (S&P) Index or Russell Midcap Value Index, regardless of market conditions. The Fund seeks to provide investment results that correspond to the total return of common stocks publicly traded in the United States. Dryden S&P Index Fund DBPDF File opens in a new window · Large Cap Growth + Jennison FundPDF File opens in a new window · Prudential Mid Cap Value*PDF File. S&P Index. The S&P is a market-weighted index of of the largest U.S. stocks in a variety of industry sectors. Russell ® Growth Index. 1, , weighted 65% S&P Index and 35% Bloomberg. Barclays Long Credit AA or Better Index. Page 8. Dryden S&P Index Fund. A Proprietary Separate. The S&P Index is an unmanaged index of stocks of large U.S. public companies. It gives a broad look at how U.S. stock prices have performed. 3The Lipper. 34% Dryden S&P index fund (large cap blend) 20% BlackRock Equity Market Index Fund (Mid cap Blend) 31% All World ex-US Stock Index Fund. The Fund intends to invest over 80% of its investable assets in securities included in the S&P Index in the same proportions as those of the Index. The Fund.

Procurando vídeos relacionados ao dryden s&p index fund (is platform) ticker? embarrassing sports photos | charlie farting | can we eat chocolate during. Large Cap Value/ LSV Asset Management Fund. Large Cap Value / AJO Fund. Large Blend. SA / Davis New York Venture Strategy. Dryden S&P Index Fund. Gross. Dryden S&P Index Fund. ______%. ______%. Large Cap Value/AJO Fund. ______ I authorize the Trustees of the Surety Fund to invest my account balance and. Jennison Dryden Funds. PURZXPGIM Global Real Estate Fund - Class Z; PHYZX SVSPXState Street S&P Index Fund N; SSBOXState Street Target Retirement. The fund has returned percent over the past year, percent over the past three years, percent over the past five years, and percent over the. • Dryden S&P Index Fund? • Large Cap Growth/ J.P. Morgan? • Large Cap Value/LSV Asset Mgmt? • Mid Cap Growth/Times Square? • Mid Cap Value/ Robeco Fund? Dryden S&P Index Fund. -. AVERAGE: Large Blend Index. INDEX: S&P TR USD. See Empower S&P ® Index Fund (MXVIX) mutual fund ratings from all the top fund analysts in one place. See Empower S&P ® Index Fund performance. Dryden S&P Index Fund, Pooled Separate Account, 4,, 10, Vanguard Wellington / Admiral Fund, Mutual Fund, 4,, 11, Fidelity Contrafund Account. Retirement Goal Fund. J% do do do. %. 2Q. 7D. 75 Retirement Goal Income Fund. SA/Oakmark Equity & Income Strategy II. Dryden S&P Index Fund. Important. This page shows ETF alternatives to the PDSIX mutual fund. The ETFs in the tables consist of ones that track the same index and are in the same ETFdb. Dryden S&P Index Fund, *, 6,, 11, Large Cap Value/LSV Asset Mgmt Dryden S&P Index Fund, N/A, 7,, 14, *, Prudential Retirement Ins. Dryden S&P Index Fund. This fund is constructed to reflect the composition of the S&P Index. It seeks to provide long-term growth of capital and. Dryden S&P Index Fund. -. AVERAGE: Large Blend Index. INDEX: S&P TR. Vanguard Small Cap Index Admiral Fund, Mutual Fund, 5,, 22, *, Prudential Prudential Retirement Dryden S&P Index Fund, Pooled Separate Account. dryden s&p index fund,SoftBank Arm IPO left millions to get win for Masayoshi Son | Fortune SoftBank left millions on the table in Arm IPO in order to. Analyze the Fund Invesco S&P Index Fund Class A having Symbol SPIAX for type mutual-funds and perform research on other mutual funds. Common Stock Fund, or the Exxon Mobil Corporation Common Stock Fund after the acquisition. Dryden S&P (R) Index Fund - Managed by Quantitative. Principal SmallCap S&P X. X. Prudential Stock. X. Dryden S&P X. Quantitative Management. Associates LLC. S&P X. Rhumbline Advisers · S&P Dryden S&P Index Fund. ______%. ______%. T Rowe Price Growth Stock Fund Vanguard Mid Cap Index Signal Fund. ______%. ______%. Vanguard Small Cap.

What Do You Do If You Lose Your W2 Form

But what do you do if you lose your W2 form when you only need certain information from it? You'll need to fill out form T to get a transcript of your. How do I obtain a copy of my W2? · Log in to using your user ID and password. · Scroll to the Individual Income Tax portion of the page and select “Submit a. If you don't have your W-2, reach out to your employer as soon as possible to see if they can provide you with another copy. Without this figure, you may not receive credit for the withholding when your residence tax is calculated. If I want to provide the information, where do I. Yes, a W-2 with unmasked SSN can be requested by completing the Request a Duplicate Tax Form. What if I don't receive my W-2 or lose the form? Your W-2 remains. If you cannot obtain your W-2 from your employer or their payroll provider, you can order a copy from the IRS by using the IRS's “Get Transcript” tool, form. 1. Give your employer's HR a call or send an email and ask for a new duplicate W 2. Check Your Email or Online Account. If you still do not receive your W-2 Form, you will need to complete Form , Substitute for Form W-2, Wage and Tax Statement to meet the deadline for filing. Lost Form W-2—Reissued statement. If an employee loses a Form W-2, write “REISSUED STATEMENT” on the new copy and furnish it to the employee. But what do you do if you lose your W2 form when you only need certain information from it? You'll need to fill out form T to get a transcript of your. How do I obtain a copy of my W2? · Log in to using your user ID and password. · Scroll to the Individual Income Tax portion of the page and select “Submit a. If you don't have your W-2, reach out to your employer as soon as possible to see if they can provide you with another copy. Without this figure, you may not receive credit for the withholding when your residence tax is calculated. If I want to provide the information, where do I. Yes, a W-2 with unmasked SSN can be requested by completing the Request a Duplicate Tax Form. What if I don't receive my W-2 or lose the form? Your W-2 remains. If you cannot obtain your W-2 from your employer or their payroll provider, you can order a copy from the IRS by using the IRS's “Get Transcript” tool, form. 1. Give your employer's HR a call or send an email and ask for a new duplicate W 2. Check Your Email or Online Account. If you still do not receive your W-2 Form, you will need to complete Form , Substitute for Form W-2, Wage and Tax Statement to meet the deadline for filing. Lost Form W-2—Reissued statement. If an employee loses a Form W-2, write “REISSUED STATEMENT” on the new copy and furnish it to the employee.

W-2s and Cs are available electronically through HR Self-Service. Do you want your W-2 and C as soon as they are available? With your tax forms now at. File your return using alternative forms. You will still have to file a tax return even if your W-2 is missing or late. To do so, you must include Form Your employer is required to issue a wage and tax statement, Form W-2, by January 31st if you earned wages during the previous calendar year. Make the process of distributing annual tax forms more efficient by providing employees online, self-service access. If you decide only to provide the forms. In the event you lose your Form W–2, or require a duplicate copy you can download a copy from Cal Employee Connect under the "W-2" tab. You also can request one. If an individual did not receive a W-2 from an employer, that person should contact the IRS at for further instructions. Individuals who lose a W The IRS will also send you Form , which you can use if you do not receive the missing form in time to file your taxes. When filling out your Form you. You may be required to file an amended return if you file your return using the Form and you do eventually receive a W-2 form with conflicting information. Your employer can replace the lost form with a “reissued statement. You still must file your tax return on time even if you do not receive your Form W Form W-2, Wage and Tax Statement, is prepared by your employer. If you did not receive your W-2, contact your employer. Employers are required to issue W If you do not receive your missing form(s) in time to file your tax return, you can use Form to complete your return. You will need to calculate your. If the companies have a payroll office, call somebody at the payroll office and ask them to email you a copy of your W I lost mine this year. You may also call the IRS self-service line at to order your transcript(s). If you order by phone, follow the prompts and select 3, then 1 to. Whenever you have to do tax filing when you're missing the W-2 form from your employer, you'll need to use Form – a substitute for W2 that has to be. Contact your employer If you have not received your W-2, contact your employer to inquire if and when the W-2 was mailed. · Contact the IRS If you do not receive. (Best Option) Ask the employer for a duplicate copy · Wage and Earning Transcripts - You can ask the IRS for a copy of what your employer told. If you forget to file a W2, you will still receive a return. However, if your tax filing error will cause you to owe additional tax, you must file an amendment. Yes, you can file an amended tax return using Form X if you didn't include your W-2 in your original tax return. Be sure to attach the missing W-2 to the. If you are unable to obtain copies of your W-2 forms you may fill out Form IL, Substitute for Unobtainable Form W-2, and attach it to your tax return. Log in to using your user ID and password. · Scroll to the Individual Income Tax portion of the page and select “Submit a Credit Claim” located in the Tax.

Credit Resource Management Phone Number

Consumers who are contacted about a debt with Credence Resource Management can pay their bills through the company's website or by calling () If you ignore attempts to contact you on legitimate debt, they can sue you. How did Credence Resource Management get my number? When debt collection. Trinity Mills Rd STE Dallas, TX Get Directions Visit Website () Want a quote from this business? Get a Quote. With expertise in improving operational efficiency, SRM provides consulting for banks and credit unions in the areas of vendor contract management. Answer their call or call their agency and ask a representative to restrict your number. Credence has suggested this option to consumers complaining on the BBB. Phone Numbers Used by Credence Resource Management · · · · · · · · They have been in business since Address: Dallas Pkwy #, Dallas, TX Phone Number: () Years in Business: 6. Business Started. This credence company seems like an Indian Scam Call Center. I don't trust giving them my card to pay this debt over the phone. Credence Resource Management is calling from We stop creditor harassment, we will remove inaccurate information from your credit records, and, if. Consumers who are contacted about a debt with Credence Resource Management can pay their bills through the company's website or by calling () If you ignore attempts to contact you on legitimate debt, they can sue you. How did Credence Resource Management get my number? When debt collection. Trinity Mills Rd STE Dallas, TX Get Directions Visit Website () Want a quote from this business? Get a Quote. With expertise in improving operational efficiency, SRM provides consulting for banks and credit unions in the areas of vendor contract management. Answer their call or call their agency and ask a representative to restrict your number. Credence has suggested this option to consumers complaining on the BBB. Phone Numbers Used by Credence Resource Management · · · · · · · · They have been in business since Address: Dallas Pkwy #, Dallas, TX Phone Number: () Years in Business: 6. Business Started. This credence company seems like an Indian Scam Call Center. I don't trust giving them my card to pay this debt over the phone. Credence Resource Management is calling from We stop creditor harassment, we will remove inaccurate information from your credit records, and, if.

Phone Numbers Used by Credence Resource Management · · · · · · · · Their aggressive approach to debt collection is likely a significant factor behind the negative feedback. What is Credence Resource Management phone number? Looking for a credit report on Credence Resource Management, LLC? Our What is Credence Resource Management, LLC's phone number? Credence Resource. Ag Resource Management is a specialty finance company focused on bringing financial and risk management solutions to farmers and agribusinesses who serve. Address: Dallas Pkwy #, Dallas, TX ; Phone: ; Email: [email protected] [email protected] Are you getting calls from a company called Credence? If you are, you should know their full name is Credence Resource Management and they are a collections. We accept credit card payments online at runninwideopen.site, opens in a new tab, over the phone at Person holding a credit card and entering. * Ranking determined by the overall number of debt collection phone calls, et cetera. All of these violate consumer protection laws on the. Account Management Resources (AMR) manages and resolves delinquent accounts for commercial and governmental entities. Braclaire Management, LLC also d/b/a Clear Credit Services, Clear Credit Solutions, Delaware Asset Management, Westwood Asset Management, Huntington Asset. If you require a payment for a future date, or would like to establish additional payments for the future, please contact our office at Thank. You can contact Credence Resource Management either by writing an email at [email protected] (for customer service) or by calling at Credence Resource Management contact info: Phone number: () Website: runninwideopen.site What does Credence Resource Management do? As part. Are you getting calls from a company called Credence? If you are, you should know their full name is Credence Resource Management Phone *. Email. to Name. What Is Credence Resource Management Phone Number? You likely want to call Credit Sage before deciding whether or not to call Credence Resource Management. I called Envision phone # - - today and they said yes it was sent to Credence phone # and they cant do anything about. Established in , Resource management Inc., a full service debt collection agency, is licensed, bonded and insured. We are located in Eau Claire, Wisconsin. Alternatively, you can contact us by calling () Account Login. Due to limited demand, Credit Corp does not currently provide access services in. phone or electric bill from years ago, it's possible that Credence Resource Management will contact you to collect the debt. Credence, and all other debt. Credence Resource Management, LLC is a Financial Services based company and has headquarters in Dallas, Texas, United States.

How Liquid Is A Mutual Fund

Mutual funds are considered liquid investments because you can usually redeem your units as the need arises and have your money available within two business. Liquid Mutual Funds Liquid Funds are a type of debts funds that invests in money market instruments with a maturity of up to 91 days. These Funds offer high. All mutual funds are liquid in the sense that they are easy to buy and sell. At the end of each trading day, all mutual fund orders are executed at the fund's. Mutual funds are considered liquid since investors can sell their shares at any time and receive their money within days. Money-market funds, a type of mutual. Learn more about Kotak Liquid Funds - what are liquid funds, how it works, who should invest, portfolio etc.. Start investing today with Kotak Mutual fund. A Liquid Fund is an open-ended debt mutual fund scheme, which according to the regulatory guidelines, is mandated to invest in debt & money markets securities. Liquid assets are easy to turn into cash with little loss in value, which makes them great for paying for unexpected costs. Cash in checking, savings. Locate an AMC Branch, Invest Online in Mutual Funds, Locate a Mutual Fund Distributor, Locate a MFU POS (Service Centre), Check out Unclaimed Dividend amount. Liquid funds are a type of Debt Mutual Funds that mainly invest in short-term debt securities, offering fixed returns. Mutual funds are considered liquid investments because you can usually redeem your units as the need arises and have your money available within two business. Liquid Mutual Funds Liquid Funds are a type of debts funds that invests in money market instruments with a maturity of up to 91 days. These Funds offer high. All mutual funds are liquid in the sense that they are easy to buy and sell. At the end of each trading day, all mutual fund orders are executed at the fund's. Mutual funds are considered liquid since investors can sell their shares at any time and receive their money within days. Money-market funds, a type of mutual. Learn more about Kotak Liquid Funds - what are liquid funds, how it works, who should invest, portfolio etc.. Start investing today with Kotak Mutual fund. A Liquid Fund is an open-ended debt mutual fund scheme, which according to the regulatory guidelines, is mandated to invest in debt & money markets securities. Liquid assets are easy to turn into cash with little loss in value, which makes them great for paying for unexpected costs. Cash in checking, savings. Locate an AMC Branch, Invest Online in Mutual Funds, Locate a Mutual Fund Distributor, Locate a MFU POS (Service Centre), Check out Unclaimed Dividend amount. Liquid funds are a type of Debt Mutual Funds that mainly invest in short-term debt securities, offering fixed returns.

The new form generally requires a fund to confidentially notify the SEC when the fund's level of illiquid investments that are assets exceeds 15 percent of its. Liquid funds are debt Mutual Funds. These funds invest in short-term market instruments like treasury bills, commercial papers and certificates of deposits. Mutual funds, known as “liquid funds”, invest in highly liquid money market products, including commercial papers, treasury bills, and certificates of deposit. Liquid alternatives, Medium, %, %, Jun 27, Expand the Mutual Funds list (off). Notes. Disclosure. Footer. Products. Mutual funds · RBC iShares. Liquid mutual funds are debt funds that invest in short-term assets like treasury bills, repurchase agreements, COD, or commercial paper. Goldman Sachs US$ Treasury Liquid Reserves Fund. ALL FUNDS BY ASSET CLASS Morningstar, Inc. is an independent publisher of mutual fund research and ratings. Definition: Liquid funds are a type of mutual funds that invest in securities with a residual maturity of up to 91 days. Assets invested are not tied up for a. Here are some common liquid asset examples that companies turn to when they need immediate funding. · Cash · Stocks · Bank accounts- · Mutual funds- · Money market. Liquid funds are a category of debt funds that invest primarily in debt and money market securities with a maturity of up to 91 days only. Liquid funds—like all mutual funds—involve investment risk, including the possible loss of principal. Investors should be aware of the risks and potential for. Liquid funds, often referred to as Liquid Mutual Funds are Debt Funds that primarily invest in short-term debt instruments with very short maturity periods. Investors earn dividends and capital gains from liquid funds. Investors do not pay any tax on dividend income from mutual funds. In case an investor earns a. Liquid funds are open-ended debt mutual funds that invest in debt and fixed income securities that come with a maturity period of up to 91 days. Liquid funds invest in Debt and money market securities for a short period. And you could gain from the potential wealth creation with low risk and high. A liquid fund is a type of mutual fund that invests in a wide range of short-term assets. These assets may include government securities, commercial papers. The Fund will comply with SEC rules applicable to all money market funds, including Rule 2a-7 under the Investment Company Act of Portfolio Managers. In investment terms, the liquidity of an asset doesn't necessarily affect its profitability. But you should keep in mind that assets that are highly liquid. But since liquid mutual funds invest in AAA rated papers, they are very safe. Taxation: Short term capital gains in liquid mutual funds are added to your income. Common examples of liquid assets include cash in bank accounts, stocks, bonds, mutual funds, and money market funds, which can be readily sold for cash. • Non-. Liquid fund is an asset that can easily be converted into cash in a small amount of time. Liquid assets or funds include things like money market.

What Is The Benefit Of Stock Split

reverse stock split? whats the advantage? It's almost always bad and there are no benefits. It's usually as a result of share prices falling. Boosted Liquidity: One of the clear benefits of a stock split is the surge in the number of shares available for trading. With more shares and on the market. Companies often choose to split their stock to lower its trading price to a more comfortable range for most investors and to increase the liquidity of trading. What is a 2 for 1 stock split? This term refers to a public company that cuts its share price in half by splitting every single share into two. Shareholders in. A stock split occurs when a company decides to increase the number of shares it has outstanding and distributes the new shares to existing shareholders in. Stock splits, defined. A stock split occurs when a public company increases its total number of outstanding (sold) shares and decreases the price per stock at. A stock split can help a company lower its share price to appeal to new investors, while a reverse stock split can boost its share price and help preserve its. Share Price Adjustment: One of the primary reasons companies choose to execute a reverse stock split is to increase their share price. A higher share price can. There is some evidence that companies who split their stock outperform the broad market over the near term. reverse stock split? whats the advantage? It's almost always bad and there are no benefits. It's usually as a result of share prices falling. Boosted Liquidity: One of the clear benefits of a stock split is the surge in the number of shares available for trading. With more shares and on the market. Companies often choose to split their stock to lower its trading price to a more comfortable range for most investors and to increase the liquidity of trading. What is a 2 for 1 stock split? This term refers to a public company that cuts its share price in half by splitting every single share into two. Shareholders in. A stock split occurs when a company decides to increase the number of shares it has outstanding and distributes the new shares to existing shareholders in. Stock splits, defined. A stock split occurs when a public company increases its total number of outstanding (sold) shares and decreases the price per stock at. A stock split can help a company lower its share price to appeal to new investors, while a reverse stock split can boost its share price and help preserve its. Share Price Adjustment: One of the primary reasons companies choose to execute a reverse stock split is to increase their share price. A higher share price can. There is some evidence that companies who split their stock outperform the broad market over the near term.

A stock split often doesn't benefit the company: it's a great example of behavioral finance at work. Here's why nothing really changes after. A company may declare a reverse stock split in an effort to increase the trading price of its shares – for example, when it believes the trading price is too. The only thing that changes is the number of shares on the market. For example, if a company you invest in issues a 2-for-1 split, you'd receive one extra share. It seems that a stock split may not result in benefits for investors who bought the split share at lower price. However, one of the possible reasons for. However, what they do is increase the number of shares of the company. A stock split could well make the shares of any given company seem more affordable. A stock split is a point at which an organization separates the current portions of its stock into various new shares to support the stock's liquidity. Who Benefits From a Stock Split? · Lower prices open the door to investors who were previously priced out, which increases demand and therefore prices. Stock split will increase the number of shares outstanding and so the liquidity of the share will be increased in the market. A company does a reverse split to increase its share price. The most common reason is to meet a requirement from a stock exchange to avoid having its shares. Advantages of Stock Splits · Boosts Liquidity: Splitting the stock enhances the total shares available in the market, potentially raising the trading volume of. Does the stock split make the company more or less valuable? Stock splits can boost trading liquidity while making the stock's price appear lower. The market. Improves Perceived Affordability: A stock split can create a perception of affordability among investors. For example, some investors may view a company's stock. One of the advantages of splitting stock is that it allows the company a lot of flexibility when doing some complex stock situations such as. A stock split can be seen as a sign of confidence from management in the company's future prospects. This positive sentiment can again attract investors and. One of the most significant advantages of stock splits is that they can increase the liquidity of a stock. By making shares more affordable, stock splits can. Why do stocks split? The main benefit of a stock split is to make a company's shares cheaper for small investors to buy. Many companies (specifically their. Companies typically engage in a stock split so that investors can more easily buy and sell shares, otherwise known as increasing the company's liquidity. Stock. Dividends are the company's payments to shareholders, and stock splits are where an individual share can be divided, making it more affordable. See. Share Price Adjustment: One of the primary reasons companies choose to execute a reverse stock split is to increase their share price. A higher share price can. Learn about conventional and reverse stock splits, how they impact a stock's value, and what they mean for investors.

Should I Start Trading Stocks

To enter the share market as a trader or an investor, you must open a demat or a brokerage account. Without a demat account, you cannot trade in the stock. Should I buy-and-hold stocks for long-term investing? As long as markets have existed, investors have tried to maximize gains and minimize losses by timing. Trading stocks can be a wonderful way to earn returns and stay in touch with the economy, but make no mistake about it, you are taking on risk. You should also start with a small amount of money and gradually increase your investment as you become more experienced. Day trading guide for beginners. Here. Indeed, this should prevent traders from greater losses if their trades are unsuccessful. Create an account to start trading both forex and stocks. This will. Stock trading for beginners involves considering your overall investment aims and your reasons for investing. Your risk-profile will dictate which types of. But if you're not careful, trades can quickly move against you, which is why most long-term investors should consider trading near the middle of the day, when. Trading stocks offers risks and rewards for traders. Whether you should trade stocks is a personal decision based on your risk tolerance, financial goals and. Once you have decided on a trading platform, the next step to start stock trading for beginners is to open an account with that platform. This process should be. To enter the share market as a trader or an investor, you must open a demat or a brokerage account. Without a demat account, you cannot trade in the stock. Should I buy-and-hold stocks for long-term investing? As long as markets have existed, investors have tried to maximize gains and minimize losses by timing. Trading stocks can be a wonderful way to earn returns and stay in touch with the economy, but make no mistake about it, you are taking on risk. You should also start with a small amount of money and gradually increase your investment as you become more experienced. Day trading guide for beginners. Here. Indeed, this should prevent traders from greater losses if their trades are unsuccessful. Create an account to start trading both forex and stocks. This will. Stock trading for beginners involves considering your overall investment aims and your reasons for investing. Your risk-profile will dictate which types of. But if you're not careful, trades can quickly move against you, which is why most long-term investors should consider trading near the middle of the day, when. Trading stocks offers risks and rewards for traders. Whether you should trade stocks is a personal decision based on your risk tolerance, financial goals and. Once you have decided on a trading platform, the next step to start stock trading for beginners is to open an account with that platform. This process should be.

The best time to buy a stock is when an investor has done their research and due diligence, and decided that the investment fits their overall strategy. With. With stocks, beginner investors must consider the degree of risk that they can take. Typically, the more risk in an investment, the greater the potential reward. Should I buy-and-hold stocks for long-term investing? As long as markets have existed, investors have tried to maximize gains and minimize losses by timing. Develop a Trading Strategy Suited to Your Goals Your strategy should include the types of stocks you're going to trade, the risks you're willing to take, and. It is worth it. You will gain the skill set to make money as long as there is a stock market. There shouldn't be any risk if you stay true to. But when you dive into the stock market as a beginner, you should invest the bulk of your holdings in diversified funds and ETFs. That is where your "real money. Before you can start purchasing stocks, you need to select a brokerage account to do it through. You can choose to go with a trading platform offered by a. For you to begin buying and selling stocks, you will need to open up a brokerage account where you can buy/ sell stocks. I recommend Charles Schwab. Who should invest in stocks? Stocks have the potential for appreciation, which historically has produced higher average returns relative to lower-risk. Whilst historically, investing in markets offers a steady return on investment that outperforms money left sitting in a savings account, trading is a much more. Do you actively trade stocks? If so, it's important to know what it A day trader should be prepared to lose all of the funds used for day trading. What risks should I know about before getting into trading? There are number Trading stocks and shares 'on margin' within a US options and futures. Everyone has to start somewhere. That old maxim certainly applies to investing or trading in stocks. Do you consider yourself a stock market newcomer? Here's. Starting a business allows you to earn active income, while investing in the stock market allows you to earn passive income. This form of trading demands a high level of discipline, as traders must make rapid, informed decisions and constantly monitor the markets. Successful day. trades overnight. Stocks that have performed well during the session could therefore begin to decline toward the market close as a result of day traders. Some common mistakes that novice share traders should avoid include having unclear investment goals, not performing adequate research before investing, and not. Stock traders using margin must maintain a balance of $25, to actively day trade as required by the Pattern Day Trader (PDT) rule. When trading futures vs. Owning stocks in different companies can help you build your savings, protect your money from inflation and taxes, and maximize income from your investments. We've outlined everything you need to know for your trading journey, including how to trade stocks and forex trading for beginners.

Term Insurance Medical Test

Policies requiring medical exams as part of the application process can include permanent life insurance. You may also need one for level term life insurance. Medical tests for term insurance are important because they set standard health parameters against which the insurance company can measure the policyholder's. What Are the Medical Tests Needed for Term Insurance? · BMI Test This test involves calculating the height and weight of the applicant. · Urine Test A series of. Many life insurance providers require applicants to take a medical exam during the application process. These exams help the insurer gather health. Convenient: Get an online quote instantly and apply in as little as 15 minutes · No Medical Exam: You may be eligible to receive coverage without having a. Medical examination does not stand mandatory for all types of term insurance plans. However, there is a certain term plan where you cannot opt. What Are Common Medical Tests for Term Insurance? · Complete blood count · Kidney function test · Liver function test · Lipid Profile · Fasting Plasma Glucose. Yes, some insurers offer life insurance policies without a medical exam, usually called guaranteed issue or simplified issue policies. The life insurance medical exam may include measuring your blood pressure, heart rate, height, and weight, and taking blood and/or urine samples. If you're. Policies requiring medical exams as part of the application process can include permanent life insurance. You may also need one for level term life insurance. Medical tests for term insurance are important because they set standard health parameters against which the insurance company can measure the policyholder's. What Are the Medical Tests Needed for Term Insurance? · BMI Test This test involves calculating the height and weight of the applicant. · Urine Test A series of. Many life insurance providers require applicants to take a medical exam during the application process. These exams help the insurer gather health. Convenient: Get an online quote instantly and apply in as little as 15 minutes · No Medical Exam: You may be eligible to receive coverage without having a. Medical examination does not stand mandatory for all types of term insurance plans. However, there is a certain term plan where you cannot opt. What Are Common Medical Tests for Term Insurance? · Complete blood count · Kidney function test · Liver function test · Lipid Profile · Fasting Plasma Glucose. Yes, some insurers offer life insurance policies without a medical exam, usually called guaranteed issue or simplified issue policies. The life insurance medical exam may include measuring your blood pressure, heart rate, height, and weight, and taking blood and/or urine samples. If you're.

The medical tests required for purchasing a term life insurance plan vary from case to case. It will depend upon the declarations made in the insurance form. Term insurance medical tests such as kidney function, liver function, blood pressure etc. are essential to evaluate policyholders' health and fitness by the. Through underwriting, insurance companies assess the medical, financial and other risks of an individual and then issue the policy if the company can undertake. Ease of Obtaining: Undoubtedly, getting term insurance without medical tests offers a swift route. Without the requirement to schedule and undergo medical. What Are the Medical Tests Required for Term Insurance? · Body Mass Index (BMI) · Urine Test · Blood Test · Complete Blood Count · Blood Sugar · Kidney Function. Term life insurance without medical exams offers coverage without the need for a medical exam. The insurance company relies on the applicant's. Simply put, the exam for life insurance portion of the application process is used to determine if you have any health conditions that could affect your rate. Yes, you can buy a term insurance plan without taking medical tests. It is an option provided by many insurance providers. During the life insurance physical, the examiner will take a blood sample for testing and he or she will check your blood pressure and pulse. You probably know. Which Medical Tests Are Required for a Term Insurance Plan? · HIV · BMI Test · Urine Test · Blood Test · Kidney Function Test · Liver Function Test · Lipid. Medical tests assess a potential policyholder's fitness and overall health and enable the insurer to fix premiums and issue policies accordingly. What do life insurance medical exams test for? · elevated blood sugar levels · abnormal liver and kidney functions · HIV · cocaine, cotinine and the substance. Term insurance policies, which do not require a medical test, usually come with heftier premiums to cover the risk of the unknown. The primary purpose of the. Medical exams are used in underwriting, the process used by insurance companies to decide how much to charge you in premiums based on your risk profile. These. Simplified Issue life insurance This is the most common no-exam life insurance, and it can come in a variety of forms. Most of the time, you complete a short. The actual term insurance medical test list depends on the insurance company, your age and the sum assured selected. It is mandatory to undergo some pre-policy medical tests. These tests are requested by the insurer to estimate the health risks that you might have. The usual tests administered, is measurement of blood pressure, ECG, lipid profile test, blood serum test, complete blood count and blood sugar. The medical. The client is above the age of 35 years. The applicant may require a medical test in case of a family medical history of underlying illnesses. Some lifestyle. The purpose of undertaking medical tests before buying a term insurance is to determine the health quotient of the applicant. Based on the test results the.

Lowes Stock Price

The Lowe's Companies Inc stock price today is What Is the Stock Symbol for Lowe's Companies Inc? The stock ticker symbol for Lowe's Companies Inc is LOW. Research Lowe's Companies' (NYSE:LOW) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and. Find the latest Lowe's Companies, Inc. (LOW) stock quote, history, news and other vital information to help you with your stock trading and investing. LOWNew York Stock Exchange • NLS real time price • USD. LOWE'S COMPANIES, INC. (LOW). at close. + (+%). Summary Financials Analysis Earnings. Based on 23 Wall Street analysts offering 12 month price targets for Lowe's in the last 3 months. The average price target is $ with a high forecast of. Lowe's Companies, Inc. Common Stock (LOW). 1D. Real time Lowe's Companies (LOW) stock price quote, stock graph, news & analysis. Lowe's Companies · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. . The current price of LOW is USD — it has decreased by % in the past 24 hours. Watch Lowe's Companies, Inc. stock price performance more closely on. The Lowe's Companies Inc stock price today is What Is the Stock Symbol for Lowe's Companies Inc? The stock ticker symbol for Lowe's Companies Inc is LOW. Research Lowe's Companies' (NYSE:LOW) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and. Find the latest Lowe's Companies, Inc. (LOW) stock quote, history, news and other vital information to help you with your stock trading and investing. LOWNew York Stock Exchange • NLS real time price • USD. LOWE'S COMPANIES, INC. (LOW). at close. + (+%). Summary Financials Analysis Earnings. Based on 23 Wall Street analysts offering 12 month price targets for Lowe's in the last 3 months. The average price target is $ with a high forecast of. Lowe's Companies, Inc. Common Stock (LOW). 1D. Real time Lowe's Companies (LOW) stock price quote, stock graph, news & analysis. Lowe's Companies · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. . The current price of LOW is USD — it has decreased by % in the past 24 hours. Watch Lowe's Companies, Inc. stock price performance more closely on.

A valuation method that multiplies the price of a company's stock by the total number of outstanding shares. B USD. Avg Volume. The average number of. The 96 analysts offering price forecasts for Lowe's Companies have a median target of , with a high estimate of and a low estimate of The. Analyst Forecast. According to 23 analysts, the average rating for LOW stock is "Buy." The month stock price forecast is $, which is an increase of. Lowe's Companies, Inc. engages in the retail sale of home improvement products. The firm offers products for maintenance, repair, remodeling, home decorating. Stock Chart & Quote · Lowe's Companies Inc. · Share information. $ Lowe's Companies Inc. share price live: LOW Live stock price with charts, valuation, financials, price target & latest insights. Lowe's Companies Inc (LOW). + (+%) USD | NYSE | Aug. Lowe's Cos. · AT CLOSE PM EDT 08/30/24 · USD · % · Volume2,, Real-time Price Updates for Lowe's Companies (LOW-N), along with buy or sell indicators, analysis, charts, historical performance, news and more. Lowe's Cos. historical stock charts and prices, analyst ratings, financials, and today's real-time LOW stock price. Stock Chart & Quote, Dividend History, Historical Price Lookup, Total Return Calculator, Corporate Governance. Discover historical prices for LOW stock on Yahoo Finance. View daily, weekly or monthly format back to when Lowe's Companies, Inc. stock was issued. Lowe's Cos. ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - The firm retains some of its cost savings and passes the rest on to its customers through everyday low prices, creating a flywheel effect. Intangible asset and. The all-time high Lowe's stock closing price was on March 21, · The Lowe's week high stock price is , which is % above the current share. Key Turning Points ; 2nd Resistance Point, ; 1st Resistance Point, ; Last Price, ; 1st Support Level, ; 2nd Support Level, Stock analysis for Lowe's Cos Inc (LOW:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. CompaniesMarketCap is receiving financial compensation for Delta App installs. CompaniesMarketCap is not associated in any way with runninwideopen.site Stock. Lowe's Companies (LOW) has a Smart Score of 6 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. Lowe's Companies Inc. ; , , , , ; , , , ,

Can You Change A Business From Sole Proprietorship To Llc

When you change from a sole proprietorship to an LLC, you must file an article of organization and register your business with your state. An article of. The short answer is yes. Learn all about the IRS EIN requirements when making the business shift to an LLC from a Sole Proprietorship! To change a sole proprietorship to an LLC, you'll need to file the necessary formation documents with your state, obtain an EIN (Employer Identification Number. It doesn't make your sole proprietorship into a registered business; it allows you to use a business name instead of your legal name. As a result, a lot of DBAs. In the vast majority of cases, small businesses change from a simple business structure (sole proprietor or simple partnership) to a more complex one (LLC or. Generally, most sole proprietors are allowed to change to an LLC. However, some states require certain licensed professionals (eg, attorneys and physicians) to. Sole proprietors · You change the name of your business. · You change your location and/or add other locations. · You operate multiple businesses. You might have to change your business name, and you'll be required to file documents and pay fees that you probably didn't have to worry about before. It can. Your LLC is disregarded for federal tax purposes, meaning it is not seen as different from you (so does not need a different EIN). Ideally, this. When you change from a sole proprietorship to an LLC, you must file an article of organization and register your business with your state. An article of. The short answer is yes. Learn all about the IRS EIN requirements when making the business shift to an LLC from a Sole Proprietorship! To change a sole proprietorship to an LLC, you'll need to file the necessary formation documents with your state, obtain an EIN (Employer Identification Number. It doesn't make your sole proprietorship into a registered business; it allows you to use a business name instead of your legal name. As a result, a lot of DBAs. In the vast majority of cases, small businesses change from a simple business structure (sole proprietor or simple partnership) to a more complex one (LLC or. Generally, most sole proprietors are allowed to change to an LLC. However, some states require certain licensed professionals (eg, attorneys and physicians) to. Sole proprietors · You change the name of your business. · You change your location and/or add other locations. · You operate multiple businesses. You might have to change your business name, and you'll be required to file documents and pay fees that you probably didn't have to worry about before. It can. Your LLC is disregarded for federal tax purposes, meaning it is not seen as different from you (so does not need a different EIN). Ideally, this.

When the business is expanding, converting from a sole proprietorship to a Limited Liability Company (LLC) can be the best decision. There are many filing responsibilities involved with deciding to change a sole proprietorship to LLC. You will also need to consider the running costs of an LLC. Once you start the LLC, it will be a completely new legal entity and it will need a new EIN and a new State Tax ID. So, in a sense, you will be starting over. You will need to file Articles of Merger with the Secretary of State. A business corporation can merge with another corporation, a limited liability company, or. In Texas, this means you must file a Certificate of Formation with the Texas Secretary of State. After the Texas Secretary of State accepts the Certificate of. If you would like to formalize your business, converting to an LLC is rather simple and affordable. You will need to take a number of steps and file specific. With this EIN, you can open a bank account under your business LLC name. Make sure you contact your business insurer and permit & license providers to let them. How to Change from Sole Proprietor to LLC: Everything You Need to Know · Less paperwork, including simpler tax returns · Own property · Avoid paying loans you've. Employer identification number or EIN is required if you are converting your business structure from a sole proprietorship to LLC as outlined by the IRS. To change your LLC into a sole proprietorship, you'll need to transfer your LLC's assets to yourself and dissolve your LLC with the state. Yes you can change your business from a sole proprietorship to an LLC. If you plan to operate (or are currently operating) your business as a sole. It's important to note that not every sole proprietorship can change to an LLC. Depending on your state and other criteria, you may need to select a different. 1. Research to Make Sure Your Business Name is Available in Your State · 2. File Articles of Incorporation with Your State Government Office · 3. Create an LLC. Step 1: Consider outside support · Step 2: Check the intended business name · Step 3: Complete your articles of organization · Step 4: Complete an LLC operating. If your business changes and you want to bring in another owner, you'll need to register for an EIN (Employer Identification Number). By bringing in another. If you have already established and registered your business and did not realize the various benefits of forming a limited liability company, you may wonder. Sole proprietors · You change the name of your business. · You change your location and/or add other locations. · You operate multiple businesses. To change your business from a sole proprietorship to an LLC, you must create an LLC according to the laws of your state, and update your sole proprietorship. It's pretty straightforward to move a sole proprietorship (or partnership) to a new state. You're required to register your new business using the “Doing.

Cost Effective Ways To Move

Here Are The Cheapest Ways To Move Locally · Rent a Truck & Do it Yourself · Renting a Container – Most Convenient Way · Towing a Trailer – Best for Self Moving. In this article, we'll explore some wallet-friendly ways to move to college. That way, you can keep your focus on what truly matters: diving headfirst into. The most cost-effective way to move long distances? Is it cheaper to rent a truck, hire movers, or drive your own car and tow another vehicle? What is the cheapest way to move across country? · You can rent a truck and do it yourself · Rent a moving container and move yourself · You can even move by. Research and plan ahead, declutter, and explore inexpensive moving options, such as partial moving services, moving containers, or truck rental companies. You can minimize the stress and inconvenience by following these tips for the cheapest ways to pack for moving. Sell everything. Travel to the new location. Rent an inexpensive room or apartment. Get a new job as required. Find a new neighborhood. Buy a. The cost for a cross-country move with a professional moving company can range anywhere from $1, to $15, Of course, the total cost will depend on the. Cost Range: Moving truck rentals for cross-country moves generally cost between $1, and $2,, depending on factors like distance and truck size. Here Are The Cheapest Ways To Move Locally · Rent a Truck & Do it Yourself · Renting a Container – Most Convenient Way · Towing a Trailer – Best for Self Moving. In this article, we'll explore some wallet-friendly ways to move to college. That way, you can keep your focus on what truly matters: diving headfirst into. The most cost-effective way to move long distances? Is it cheaper to rent a truck, hire movers, or drive your own car and tow another vehicle? What is the cheapest way to move across country? · You can rent a truck and do it yourself · Rent a moving container and move yourself · You can even move by. Research and plan ahead, declutter, and explore inexpensive moving options, such as partial moving services, moving containers, or truck rental companies. You can minimize the stress and inconvenience by following these tips for the cheapest ways to pack for moving. Sell everything. Travel to the new location. Rent an inexpensive room or apartment. Get a new job as required. Find a new neighborhood. Buy a. The cost for a cross-country move with a professional moving company can range anywhere from $1, to $15, Of course, the total cost will depend on the. Cost Range: Moving truck rentals for cross-country moves generally cost between $1, and $2,, depending on factors like distance and truck size.

There are a lot of ways you can save money when moving. In this guide, we'll share some handy tips to help you save on moving costs. Costs will be determined by the duration of rental of the container as well as the container size. Generally, the cost of renting a moving container for a long-. The cheapest way to move cross country is to use your own truck/trailer & move yourself. A unique option for those who don't own a trailer is to buy one and. It might be cheaper to sell big furniture and repurchase them than pay 2k to have it moved. Fit whatever you can in a car or boxes you can mail. Consider renting a truck or using an app like Dolly for smaller moves. Use online resources such as Craigslist, Freecycle, and LetGo to get rid of items you don. Consider renting a truck or using an app like Dolly for smaller moves. Use online resources such as Craigslist, Freecycle, and LetGo to get rid of items you don. You can minimize the stress and inconvenience by following these tips for the cheapest ways to pack for moving. The first on our list of cheapest ways to move across the country is moving by yourself. Now, this doesn't mean you have to move alone, rather you make a DIY. 5 Cheapest Ways to Move Cross Country · Rent a portable moving container. This option gives you a number of benefits for $2, or more less than hiring a moving. 5 Cheapest Ways to Move Cross Country · Rent a portable moving container. This option gives you a number of benefits for $2, or more less than hiring a moving. An easy and possibly even cheaper way to move across the country is to ship your items via a delivery service instead of moving them. Read on to learn about various cost-effective ways to pack for your move. Our tips will help you save money and time when you're packing for your relocation. You can often save money on the move by doing it yourself. You could potentially borrow a truck or trailer for short distance move or rent a U-Haul and drive. One of the best cheap ways to move out of state is to choose an off-season move. Relocating during peak season can be expensive, and it's often hard to find. If you are uncomfortable with shipping your items and don't believe that you will be able to move your belongings on your own, then a professional moving. The cheapest way to move cross the country is by hiring a moving company that offers a not-to-exceed rate. This means you'll pay one price for the entire move. Renting a truck and doing it yourself is the most cost-effective way to move. Enlist your friends and family for packing, and read the fine print for mileage. Consider a moving container or “shared load” moving like PODS – Moving container companies like PODS offer a cheaper alternative to traditional moving companies. If you pack your own belongings, rent a moving truck, load it yourself, and drive it yourself across the country, towing your car behind you. If you pack your own belongings, rent a moving truck, load it yourself, and drive it yourself across the country, towing your car behind you.