runninwideopen.site

News

Silicon Valley Bank Locations

Get more information for Silicon Valley Bank in Toronto, ON. See reviews, map, get the address, and find directions. Discover SVB's global presence with our Locations page. Explore our network worldwide for convenient banking solutions tailored to your needs. SVB Bank Locations in United States · Boston, MA · San Diego, CA · Boston, MA · Pasadena, CA · San Francisco, CA · San Francisco, CA · Denver, CO. Silicon Valley is a region in Northern California that is a global center for high technology and innovation. Located in the southern part of the San. Silicon Valley Bank locations by city · Austin, TX out of 5 stars. · Boston, MA out of 5 stars. · Broomfield, CO out of 5 stars. · Silicon Valley Bank is not active anymore since 03/10/ due to Absorption - Assisted. Deposit Insurance National Bank of Santa Clara was the successor. Silicon Valley Bank is headquartered in Santa Clara, CA and has 21 office locations located throughout the US. See if Silicon Valley Bank is hiring near you. Financial Data; Organization Hierarchy; History; Branches. Bank Holding Company Performance Report (BHCPR) Open/close section. Locations · Tasman Drive. Santa Clara, CA , US · Howard St. San Francisco, CA , US · Sand Hill Rd. Menlo Park, CA , US · 80 E Rio. Get more information for Silicon Valley Bank in Toronto, ON. See reviews, map, get the address, and find directions. Discover SVB's global presence with our Locations page. Explore our network worldwide for convenient banking solutions tailored to your needs. SVB Bank Locations in United States · Boston, MA · San Diego, CA · Boston, MA · Pasadena, CA · San Francisco, CA · San Francisco, CA · Denver, CO. Silicon Valley is a region in Northern California that is a global center for high technology and innovation. Located in the southern part of the San. Silicon Valley Bank locations by city · Austin, TX out of 5 stars. · Boston, MA out of 5 stars. · Broomfield, CO out of 5 stars. · Silicon Valley Bank is not active anymore since 03/10/ due to Absorption - Assisted. Deposit Insurance National Bank of Santa Clara was the successor. Silicon Valley Bank is headquartered in Santa Clara, CA and has 21 office locations located throughout the US. See if Silicon Valley Bank is hiring near you. Financial Data; Organization Hierarchy; History; Branches. Bank Holding Company Performance Report (BHCPR) Open/close section. Locations · Tasman Drive. Santa Clara, CA , US · Howard St. San Francisco, CA , US · Sand Hill Rd. Menlo Park, CA , US · 80 E Rio.

Find a First Republic Bank location near you in Silicon Valley and view hours and branch office details. Company profile page for Silicon Valley Bank including stock price, company news, executives, board members, and contact information. SVB Bank Locations in United States · Boston, MA · San Diego, CA · Boston, MA · Pasadena, CA · San Francisco, CA · San Francisco, CA. Skip to Content. SVB. Silicon Valley Bank · SVB Private. Region: Silicon Valley Bank Locations. Find an SVB location near you. Resources. Newsroom · Careers. Silicon Valley Bank locations by city · Austin, TX out of 5 stars. · Boston, MA out of 5 stars. · Broomfield, CO out of 5 stars. · Silicon Valley Bank is headquartered in Santa Clara, CA and has 21 office locations located throughout the US. See if Silicon Valley Bank is hiring near you. Silicon Valley Bank's Chicago Office Relocates to Larger Location to Accommodate Growth. Chicago location enables Bank to serve clients more effectively. Find local SVB Bank branch and ATM locations in New York, United States with addresses, opening hours, phone numbers, directions, and more using our. Silicon Valley Bank's Santa Monica office is one of the locations where Silicon Valley Bank helps innovative companies and their investors move bold ideas. All California Union Bank NA & Santa Barbara Bank & Trust branches, All Valley Business Bank(Acquired By Citizens Business Bank), , FDIC ID. Latest news, articles and videos about Silicon Valley Bank from The Globe and Mail. SILICON VALLEY BANK, Howard St, Fl 3, San Francisco, CA , Mon - am - pm, Tue - am - pm, Wed - am - pm. Silicon Valley Bank overview · runninwideopen.site · Santa Clara, United States · to Employees · 15 Locations · Type: Subsidiary or Business Segment · Founded in. We'll be getting a sense of how they're doing as they report quarterly results this week. A view inside a Silicon Valley Bank location in March Find 5 listings related to Silicon Valley Bank in Santa Rosa on runninwideopen.site See reviews, photos, directions, phone numbers and more for. Silicon Valley is a region in Northern California that is a global center for high technology and innovation. Located in the southern part of the San. The 17 former branches of Silicon Valley Bridge Bank, N.A. will operate under First–Citizens Bank & Trust Company, on March 27, The branches will open. As many of you are aware, Silicon Valley Bank (SVB), a bank licensed by the Offices and locations. Norton Rose Fulbright © All Rights Reserved. Find out what works well at Silicon Valley Bank from the people who know best. Get the inside scoop on jobs, salaries, top office locations. The official website is runninwideopen.site Silicon Valley Bank is popular for Banks & Credit Unions, Financial Services. Silicon Valley Bank has 6 locations on Yelp.

Finance With Low Interest

Best Low-Interest Personal Loans of August · What Are the Best Low-Interest Personal Loans? · SoFi · LightStream · PenFed Credit Union · First Tech Federal. No collateral required. Interest rates as low as % APR. Maximum loan amount for existing customers is $ U.S. News' experts evaluated the top lenders to find the best low interest rate personal loans. Learn which companies offer the best rates. With such great financing offers, salespeople are often disinclined to come down on purchase price. Buyers should avoid overpaying just because of low-interest. No collateral required. Interest rates as low as % APR. Maximum loan amount for existing customers is $ You might also be able to get a lower interest rate if you consolidate debt with a personal loan. If you have credit card debt on a few different cards that. Compare the best low-interest personal loans ; Upstart. % to %. $1, to $50, ; PenFed. % to %. $ to $50, ; Prosper. % to %. Find personal loans with low monthly payments through Fiona, a loan search engine and Earnest partner. Enter your details, get your rates. No credit check. Happy Money. 36 months. Term of Loan. %. Fixed APR. $ · Best Egg. 36 months. Term of Loan. %. Fixed APR. $ · LightStream. 60 months. Term of. Best Low-Interest Personal Loans of August · What Are the Best Low-Interest Personal Loans? · SoFi · LightStream · PenFed Credit Union · First Tech Federal. No collateral required. Interest rates as low as % APR. Maximum loan amount for existing customers is $ U.S. News' experts evaluated the top lenders to find the best low interest rate personal loans. Learn which companies offer the best rates. With such great financing offers, salespeople are often disinclined to come down on purchase price. Buyers should avoid overpaying just because of low-interest. No collateral required. Interest rates as low as % APR. Maximum loan amount for existing customers is $ You might also be able to get a lower interest rate if you consolidate debt with a personal loan. If you have credit card debt on a few different cards that. Compare the best low-interest personal loans ; Upstart. % to %. $1, to $50, ; PenFed. % to %. $ to $50, ; Prosper. % to %. Find personal loans with low monthly payments through Fiona, a loan search engine and Earnest partner. Enter your details, get your rates. No credit check. Happy Money. 36 months. Term of Loan. %. Fixed APR. $ · Best Egg. 36 months. Term of Loan. %. Fixed APR. $ · LightStream. 60 months. Term of.

Create an account to start talking to interested lenders; Lenders will approve and help you manage your loan. SBA only makes direct loans in the case of. A secured loan is backed by collateral and usually provides a lower rate. Finance your personal expenses, qualify for a lower interest rate, maintain your. Interest free loans don't really exist. However, you could get an interest free loan period when borrowing with a credit card. Some banks may allow for interest. History tells us that taking out loans at 5% to 10% APR might not be a big deal if you can handle the financial obligation. However, the best interest rate is. LightStream online lending offers loans for auto, home improvement and practically anything else, at low rates for those with good credit. High interest rates — Because NetCredit works with people who have bad credit, the interest rates the company offers are higher than what you may find from. Collateral is usually not required and personal loans typically have lower interest rates than most credit cards. low debt-to-income ratio, and a good credit. Best personal loan lenders for a credit score of or lower · Best for people without a credit history: Upstart Personal Loans · Best for debt consolidation. The higher your credit score and income, the better chances you have of qualifying for the lowest personal loan interest rates. A low debt-to-income ratio can. For loans with rates fixed for 5 years or more: The prior business day's 5 Year Treasury note rate plus %. *Note: If SOFR is less than %, lenders may add. Save thousands with a low, fixed-rate personal loan. With credit card rates The 'High-Interest Rate Credit-Card' APR shown is the average credit. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Combine all your debt into one monthly payment with a loan that has a lower interest rate. No Collateral Required. Credit Card Consolidation. Minimum loan amount is $1, and loan terms range from 12 to 84 months (up to 60 months for non-customers). The lowest APR in the range is available on loans. Your prequalification · Our home loans — and low home loan rates — are designed to meet your specific home financing needs · Today's competitive mortgage rates. Rates as low as % APRFootnote 1 The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a. Get your rate. It takes less than 5 minutes to check your rate—and it won't affect your credit score.¹. Upstart Personal Loan Borrow Amount page ; Get approved. Lenders offer minimum payments as a guideline but they're often calibrated to be so low that they leave borrowers paying more interest for a longer period of. A personal loan is one way to consolidate debt or to pay for major expenses. These types of personal loans offer fixed interest rates and fixed monthly payments. A lower interest rate will cost you less over the life of a loan and credit card purchases. Interest rates will inevitably be a large part of your financial.

Can I Pull From 401k To Buy House

You can typically borrow up to half of the vested balance of your k, or a maximum of $50, Most k loans must be repaid within five years, although some. Putting a clear plan in place could help you save the money you need for a house down payment. Whether you're buying your first home or looking to upgrade to a. Pulling from your k will nuke your retirement savings permanently. Other options include pulling from a Roth or taxable account if you have. How Much of Your (k) Can Be Used For Home Purchase? Generally, home buyers who want to use their (k) funds to finance a real estate transaction can borrow. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. Buying a home can be a huge financial undertaking, often requiring years of planning and saving, using a (k) retirement plan to buy a home is possible. Raiding your (k) for a home down payment might make sense in some scenarios, but it generally has a lot of drawbacks. Typically if you withdraw money out of your Traditional IRA prior to age 59 you have to pay ordinary income tax and a 10% early withdrawal penalty on the. Generally, you can use funds from your (k) to buy a house. Whether it is a good idea depends on your financial situation as there are drawbacks. You can typically borrow up to half of the vested balance of your k, or a maximum of $50, Most k loans must be repaid within five years, although some. Putting a clear plan in place could help you save the money you need for a house down payment. Whether you're buying your first home or looking to upgrade to a. Pulling from your k will nuke your retirement savings permanently. Other options include pulling from a Roth or taxable account if you have. How Much of Your (k) Can Be Used For Home Purchase? Generally, home buyers who want to use their (k) funds to finance a real estate transaction can borrow. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. Buying a home can be a huge financial undertaking, often requiring years of planning and saving, using a (k) retirement plan to buy a home is possible. Raiding your (k) for a home down payment might make sense in some scenarios, but it generally has a lot of drawbacks. Typically if you withdraw money out of your Traditional IRA prior to age 59 you have to pay ordinary income tax and a 10% early withdrawal penalty on the. Generally, you can use funds from your (k) to buy a house. Whether it is a good idea depends on your financial situation as there are drawbacks.

3 penalty-free ways to use retirement savings for a home purchase · Western Alliance Bank High-Yield Savings Account · Withdraw Roth IRA account contributions. How Much of Your (k) Can Be Used For Home Purchase? Generally, home buyers who want to use their (k) funds to finance a real estate transaction can borrow. Well, it can be done. You can borrow or withdraw money from your (k) to buy a house. But most experts say it isn't a great idea. We'll explore the ins. The only way to withdraw funds early from a (k) is to claim a hardship withdrawal. The IRS generally allows the funds withdrawal as a hardship if you claim. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. Pulling from your k will nuke your retirement savings permanently. Other options include pulling from a Roth or taxable account if you have. Before borrowing, figure out if you can comfortably pay back the loan. The maximum term of a (k) loan is five years unless you're borrowing to buy a home, in. 3 penalty-free ways to use retirement savings for a home purchase · Western Alliance Bank High-Yield Savings Account · Withdraw Roth IRA account contributions. Yes, account holders may borrow money from their (k) accounts to buy a second house. However, if they buy a second home with the capital retrieved from their. Yes, you can withdraw from a K for a first time home purchase. First-time homebuyers have the option to withdraw up to $10, from their k with no. You do not have to pay the early withdrawal penalty or income tax on the amount you initially withdraw because you are essentially lending money to yourself. You can use your (k) for a down payment by withdrawing funds or taking out a loan. Each option has its own pros and cons — the best for you will depend. Raiding your (k) for a home down payment might make sense in some scenarios, but it generally has a lot of drawbacks. Option 1: Take a (k) Loan · The IRS is able to limit how much money you can borrow for a house downpayment. · Depending on your (k) plan, you could have up. Whereas IRAs can be used to invest directly in real estate, tax laws prohibit people from using their k to invest directly in real estate. That said, there. Typically if you withdraw money out of your Traditional IRA prior to age 59 you have to pay ordinary income tax and a 10% early withdrawal penalty on the. You can borrow against your (k) for a variety of reasons, such as funding the purchase of a house or paying for a dependent's college tuition. While. You would have to set the (K) so it could hold real-estate. (K) accounts have annual limits, so say that you had a $, house that you. You can use your (k) for a down payment by withdrawing funds or taking out a loan. Each option has its own pros and cons — the best for you will depend. You can borrow against your (k) for a variety of reasons, such as funding the purchase of a house or paying for a dependent's college tuition. While.

How Accurate Is Kelley Blue Book

Are Kelley Blue Book Values Accurate? KBB leverages vast amounts of data including wholesale and retail sales transactions, which are then adjusted for. For over 90 years, Kelley Blue Book has been The Trusted Resource for used car values, helping car owners understand what their used car is worth. The accuracy of KBB values can vary depending on several factors, such as the condition of the vehicle, its location, and the current market demand for that. Kelley Blue Book® (KBB) has been a trusted resource for car buyers and sellers for many years. It provides valuable information on vehicle pricing, reviews. Black Book is considered by the industry to be more accurate at valuing cars than Kelley Blue Book. For more accurate car pricing, most dealers believe Kelley Blue Book or Edmunds, while NADA can hardly be used for real references. How to Get the Most Accurate. Your VIN or license plate helps us confirm vehicle details and ensure a more accurate set of values. Enter your digit VIN. Where do I find my VIN? Email. For more accurate car pricing, most dealers believe Kelley Blue Book or Edmunds, while NADA can hardly be used for real references. How to Get the Most Accurate. The short answer is no. Let me explain what goes into these price guidelines. Dealers use Kelly Blue Book to establish the value of trade-ins as well as. Are Kelley Blue Book Values Accurate? KBB leverages vast amounts of data including wholesale and retail sales transactions, which are then adjusted for. For over 90 years, Kelley Blue Book has been The Trusted Resource for used car values, helping car owners understand what their used car is worth. The accuracy of KBB values can vary depending on several factors, such as the condition of the vehicle, its location, and the current market demand for that. Kelley Blue Book® (KBB) has been a trusted resource for car buyers and sellers for many years. It provides valuable information on vehicle pricing, reviews. Black Book is considered by the industry to be more accurate at valuing cars than Kelley Blue Book. For more accurate car pricing, most dealers believe Kelley Blue Book or Edmunds, while NADA can hardly be used for real references. How to Get the Most Accurate. Your VIN or license plate helps us confirm vehicle details and ensure a more accurate set of values. Enter your digit VIN. Where do I find my VIN? Email. For more accurate car pricing, most dealers believe Kelley Blue Book or Edmunds, while NADA can hardly be used for real references. How to Get the Most Accurate. The short answer is no. Let me explain what goes into these price guidelines. Dealers use Kelly Blue Book to establish the value of trade-ins as well as.

The Kelley Blue Book price guide provides an estimated value of many vehicles, it does not provide the value of a specific vehicle. The Kelley Blue Book and Black Book both claim to be the most accurate source of information when it comes to pricing used cars, but they actually serve. With all of this data, you can see how Kelley Blue Book provides the most current, market-reflective information. Their data-driven information inspires. Kelley Blue Book has been providing used car values for over a century. There is a reason why you typically hear, "What is the Blue Book value?" KBB has been a. KBB is one of the top 3 value sources for used vehicles- so I would say they are extremely accurate, although miles and condition can have an. One of the key ways we uphold these values is by using Kelley Blue Book (KBB) to value the vehicles we buy and sell. KBB's longstanding reputation for accurate. The Blue Book value has little impact at the point of sale. Damage and repair costs make the value of salvage vehicles less likely to be accurate. Salvage. runninwideopen.site has a proprietary valuation process that uses predictive analytics, industry data analysis, and field analysis to review auto trends. We take this data. The Kelley Blue Book (KBB) can be a useful starting point for determining car values, but it often falls short for junk cars. KBB valuations primarily. accurate appraisal of condition. This value will likely be less than the Kelley Blue Book® Private Party Value because the reselling dealer incurs the cost. Unfortunately, with the ever-changing market today the used car blue book value that you are getting may not be accurate. The Kelley Blue Book determines the. When determining the value of your used car, Kelley Blue Book will give you a price based on four condition levels: Fair, Good, Very Good and Excellent. Many. Edmunds and Kelley Blue Book (KBB) provide information on the value of vehicles, but which one is more accurate? We are going to break down everything you need. runninwideopen.site has a Fair Purchase Price and Fair Market Range for Certified Pre-Owned vehicles too. What's my car worth? Car Values actually depend on how you get rid. Kelley Blue Book is widely used to determine a car's value. However, KBB values don't always reflect the true market value of damaged or junk cars. While Kelley Blue Book tried to make sure that all the information on their site it up-to-date and relevant to the current marketplace, no on can be perfect. Kelly Blue Book provides a unique set of values for used vehicles, including retail value, private party value, and trade-in value. While Kelley Blue Book (KBB) is a trusted resource for car valuations, it primarily provides a general range of prices for vehicles in good condition. Kelley Blue Book does not address gray market vehicles; therefore yours may have to be privately appraised. I totaled my car. How will the insurance company. Kelly Blue Book® is not reliable as current with accurate information; they're misleading you. Enter your car, truck, van, or SUV's information into our short.

How To Invest $50 000

Listen to this episode from The College Investor Audio Show on Spotify. If you have $ to invest today, here are a few considerations to be aware of so. Invest $, per year in iBond with the treasury department. After a 5 years you will be able to withdraw it without penalty. You can't withdraw it in Investing $50, wisely depends on your financial goals, risk tolerance, and time horizon. Consider diversifying across different asset classes like stocks. The major benefit of investing $50, in a plan is that it allows your money to grow tax-free as your children grow up. Here are some other features. Nine ways to invest $50, · 1. Open a brokerage account · 2. Invest in an IRA · 3. Contribute to a health savings account (HSA) · 4. Look into a savings. Answer to: Cyndee wants to invest $ Her financial planner advises her to invest in three types of accounts: one paying 3%, one paying %. The bottom line. There are many ways to invest $50, The trick to making the smartest investment for you is in the planning. Diversifying your investments. The balance tiers are $20, for the Gold tier, $50, for the Platinum tier, $, for the Platinum Honors tier, $1,, for the Diamond tier and. Know that with an income of $50,, the constraints of living expenses may at first keep you from investing as much as you would like. The key, though, is to. Listen to this episode from The College Investor Audio Show on Spotify. If you have $ to invest today, here are a few considerations to be aware of so. Invest $, per year in iBond with the treasury department. After a 5 years you will be able to withdraw it without penalty. You can't withdraw it in Investing $50, wisely depends on your financial goals, risk tolerance, and time horizon. Consider diversifying across different asset classes like stocks. The major benefit of investing $50, in a plan is that it allows your money to grow tax-free as your children grow up. Here are some other features. Nine ways to invest $50, · 1. Open a brokerage account · 2. Invest in an IRA · 3. Contribute to a health savings account (HSA) · 4. Look into a savings. Answer to: Cyndee wants to invest $ Her financial planner advises her to invest in three types of accounts: one paying 3%, one paying %. The bottom line. There are many ways to invest $50, The trick to making the smartest investment for you is in the planning. Diversifying your investments. The balance tiers are $20, for the Gold tier, $50, for the Platinum tier, $, for the Platinum Honors tier, $1,, for the Diamond tier and. Know that with an income of $50,, the constraints of living expenses may at first keep you from investing as much as you would like. The key, though, is to.

Speaking of rentals, let's dwell on this investment for a while. There are many ways to earn a rental income these days! $50, can go a long way, especially. You are looking for the most passive investment possible. Why? Because you are still in increase income mode. If you make 12% on $50,, you. Making consistent investments over a number of years can be an effective strategy to accumulate wealth. Even small additions to your investment add up over. Account investment minimum is $50, for Fidelity® Wealth Services. You could lose money by investing in a money market fund. An investment in a money market. You can invest in stocks and exchange-traded funds, or you use the money to improve your current financial situation. The best way to invest $50, is investing in cryptocurrency, Crypto is the fastest and growing way to double your funds within a short period of time. NEW POST!! I chose to invest $ in a real estate fund one year ago. At that time, I had given a few reasons as to my choice to go with. This hypothetical example assumes a 6% return on a $50, investment. If the rate of return were altered, results would vary from those shown. The shaded. Your plan is on track to exceed your goal of $50,? Investment Best Ways to Invest $30K · Best Online Brokers for Stocks · Best Brokers for Low. Enrollments in Personal Advisor require an aggregate $50, balance or greater in eligible Vanguard Brokerage Accounts. All investing is subject to risk. This seventh edition of How to Invest $$5, shares Nancy Dunnan's years of financial expertise. Written in an easy-to-follow format so that even the most. Investment Strategy · Risk level: Low. If you don't have a fully-funded emergency fund), this should be your top investment priority. · Hire a Financial Advisor. Use our free investment calculator to estimate how much your investments or savings will compound over time, based on factors like how much you plan to save. The best way to invest $50, depends on your risk tolerance and financial goals. Consider a diversified portfolio with a mix of: Stocks: For. Question: Cyndee wants to invest $50, Her financial planner advises her to invest in three types of accounts: one paying 3%, one paying 5½%, and one paying. Now, you have a total of $, invested. Every month, you get six cash flow distribution checks (for Syndications B-G), totaling $3, per month, or about. I think that people don't want to invest their money into a business, for fear that something will go wrong. Even if something does go wrong, learn from your. As a most basic example, Bob wants to calculate the ROI on his sheep farming operation. From the beginning until the present, he invested a total of $50, How to invest $ in real estate Want to start investing in real estate? Visit our page and apply today! Regular investments in low fee index funds can be a great way to invest, either through a retirement fund, k, SEP-IRA, etc. Total market index funds that.

Fastest Way To Become A Billionaire

Become a Billionaire, enhance your earning capacity, and build multiple sources of income. It helps you become a billionaire faster. If you. The Fastest Way To Become A Billionaire Author: D Ahmed Mustafa Metwally Category: Business Virtues [Edit] Language: Arabic Pages: 88 Files Size: MB. Do: Invent · Do: Innovate · Do: Invest · Do: Be an Entrepreneur · Don't: Think You Know It All · Don't: Make Flashy Investments · Don't: Quit Too Soon · How Can I. This would not be a permanent fix for all Americans. Surely, some would quickly return to poverty, and others face debts so large that the subsidy would make. To become a billionaire from scratch, requires having an idea or creating a product that revolutionizes an industry. When Mark Zuckerberg took. Becoming a billionaire fast is really rare and needs a mix of great skills, never giving up, and some luck. Some ways to get rich quick are. Anyone can build wealth, but your beliefs about money can affect how much wealth you'll build.” Introduction If you have no business degree. Problem is, we quickly adapt to these material comforts—what One way to distinguish happiness from meaning is that happiness is the day. On average it takes a person 21 years of hard work to become a billionaire according to OLGB, but these magnates got the job done in a fraction of that time. Become a Billionaire, enhance your earning capacity, and build multiple sources of income. It helps you become a billionaire faster. If you. The Fastest Way To Become A Billionaire Author: D Ahmed Mustafa Metwally Category: Business Virtues [Edit] Language: Arabic Pages: 88 Files Size: MB. Do: Invent · Do: Innovate · Do: Invest · Do: Be an Entrepreneur · Don't: Think You Know It All · Don't: Make Flashy Investments · Don't: Quit Too Soon · How Can I. This would not be a permanent fix for all Americans. Surely, some would quickly return to poverty, and others face debts so large that the subsidy would make. To become a billionaire from scratch, requires having an idea or creating a product that revolutionizes an industry. When Mark Zuckerberg took. Becoming a billionaire fast is really rare and needs a mix of great skills, never giving up, and some luck. Some ways to get rich quick are. Anyone can build wealth, but your beliefs about money can affect how much wealth you'll build.” Introduction If you have no business degree. Problem is, we quickly adapt to these material comforts—what One way to distinguish happiness from meaning is that happiness is the day. On average it takes a person 21 years of hard work to become a billionaire according to OLGB, but these magnates got the job done in a fraction of that time.

The Easiest Way To Become Wealthy @DANIEL MAC @Barbara Corcoran #realeastate How to Become Billionaire · Rich Businessman · What Is Asset Rich Cash. How to Be a Billionaire looks at the careers, the methods, and the minds of self-made billionaires to distill the common keys to titanic accumulations of wealth. Legally. November 21st, In light of recent events around crypto, I wanted to show how you can quickly and % legally become a crypto billionaire. Inheritance is the fastest and easiest way to become a billionaire. Being born to a multi billionaire who who dies soon thereafter and leaves everything to you. THE FASTEST WAY TO BECOME A BILLIONAIRE [Truman, Michael] on runninwideopen.site *FREE* shipping on qualifying offers. THE FASTEST WAY TO BECOME A BILLIONAIRE. Do: Invent · Do: Innovate · Do: Invest · Do: Be an Entrepreneur · Don't: Think You Know It All · Don't: Make Flashy Investments · Don't: Quit Too Soon · How Can I. faster than others. This module will How do we measure a nation's wealth? This lesson introduces students to the idea that there is more than one way. How to Be a Billionaire is the first comprehensive picture of the real strategies and tactics that built the great business fortunes of modern times. Packed. If you want to become a billionaire, you have to be at least a partial owner of a very large company. Ideally, you should start that company, and hold on to a. How long would it take for you to become a billionaire? Let's say that you If we allow your friend just 3 seconds to say each number, which is probably faster. Becoming an actor is the most reliable way to becoming a billionaire, but it isn't the quickest. · If you manage to get a character that is part of a royal. Keys to Becoming a Billionaire · 1. Listen to Your Own Drummer · 2. Dream Big · 3. Be Totally Committed to Success · 4. Don't Be Afraid to Fail · 5. Pay Attention to. The fastest path to become a millionaire and. A billionaire is a person with a net worth of at least one billion units of a given currency, usually of a major currency such as the United States dollar. The point here is that the fastest way to build wealth is to invest a certain amount regularly. Thus, when creating your budget, you should set aside a. 1. Invest in stocks and mutual funds. Many people become billionaires by investing which gives them the potential for massive rewards. While there is no guaranteed path to becoming a zillionaire, here are some strategies that have proven successful for many wealthy individuals: Identify Market. The quickest way to become a millionaire in the airline business is to start out as a billionaire.” — Richard Branson quotes from runninwideopen.site Next, let's explore a powerful way to build mastery in your life FAST. 5. Invest in Yourself. When I decided to become a professional writer. The Billionaires who got richest quickest revealed · In this pin, I have shared about the Billionaires who got the Richest quickest in how many years, So you.

The Best Bank

The best banks & credit unions in the Capital Region · Broadview Federal Credit Union. Best of Capital Region Winner · Trustco Bank. Best of Capital Region 2nd. For the second year in a row, Standard Bank walks away with the award for the best bank in Africa. And for good reason. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Whether it's every day purchases, a new car, home purchase or financing a vacation, you'll pay less in interest when you bank with LMCU. Pay less for your. American Savings Bank (ASB) has been named to America's Best In-State Banks Forbes Magazine's list of America's Best In-State Banks for the fifth year. The nine banks highlighted in this article – Citibank, TD Bank, JP Morgan, Chase, Wells Fargo, Bank of America, HSBC, Morgan Stanley, and PNC – are among the. Compare the best bank accounts in Canada including chequing & savings accounts from the big banks, digital banks, and credit unions. WaFd Bank is proud to have received this award! From digital options, touchless transactions and increased non-profit contributions to help our neighbors, we'. Martin Lewis reveals how to compare and switch to the best current accounts that can save you £s a year. The best banks & credit unions in the Capital Region · Broadview Federal Credit Union. Best of Capital Region Winner · Trustco Bank. Best of Capital Region 2nd. For the second year in a row, Standard Bank walks away with the award for the best bank in Africa. And for good reason. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Whether it's every day purchases, a new car, home purchase or financing a vacation, you'll pay less in interest when you bank with LMCU. Pay less for your. American Savings Bank (ASB) has been named to America's Best In-State Banks Forbes Magazine's list of America's Best In-State Banks for the fifth year. The nine banks highlighted in this article – Citibank, TD Bank, JP Morgan, Chase, Wells Fargo, Bank of America, HSBC, Morgan Stanley, and PNC – are among the. Compare the best bank accounts in Canada including chequing & savings accounts from the big banks, digital banks, and credit unions. WaFd Bank is proud to have received this award! From digital options, touchless transactions and increased non-profit contributions to help our neighbors, we'. Martin Lewis reveals how to compare and switch to the best current accounts that can save you £s a year.

United takes the no. 1 spot in the state on the outlet's list of America's Best Banks after earning a top ranking on its America's Most Trustworthy. We looked for banks with little to no fees, no minimum balance requirement, and excellent online access, among other criteria. CIBC Agility is the bank's online banking arm Colorado Federal Savings Bank – % APY. Term (months): 12; Minimum deposit: $5,; Early withdrawal. Bank Independent has been recognized as the best bank in Alabama and ranks number 1 in the State of Alabama as part of Forbes' annual nationwide list. I want to pursue an FP role and figured working for a big 6 would be better for me than going independent as I feel I'd have a hard time getting clients. Cornhusker Bank is more than just a financial institution. We're your neighbor. As a member of the Lincoln community for more than years. There's only one way to be sure you're getting the best available rate, and that's to shop at least three lenders, including large banks, credit unions and. Bank of America Advantage Banking. Get the flexibility you deserve. Choose a checking account to meet you where you are in your journey. We've curated a list of the 10 top banks for various banking needs—including both brick-and-mortar banks and online-only banking options —to help you narrow. When Forbes released its Best-In-State Banks , First Interstate achieved the number one spot in the Oregon. Check out the best bank promotions in Canada. Browse new bank account offers including cash, rewards points, bonus interest rates and more. Best online banks: The 10 best for September · NBKC Bank: 4 stars · 9. First Internet Bank: 4 stars · 8. Varo Bank: 4 stars · 7. Axos Bank: 4 stars · 6. These are the national banks near San Francisco that SFGATE readers named the best; depending on your financial goals, one is likely the best for you. We've updated our favorites list, in no particular order, to highlight those websites that we believe truly stand out. Read on to discover some of the top. Forcht Bank is listed as the #1 ranked bank in Kentucky ahead of four other banks that also made the list of Best-In-State Banks. WaFd Bank is proud to have received this award! From digital options, touchless transactions and increased non-profit contributions to help our neighbors, we'. Compare Bank & Credit Union Rates. Compare more than , deposit rates from over 11, banks and credit unions, for free. SAVINGS ACCOUNTS. Top 1%. Why a City National Bank Checking Account? At City, we offer a wide variety of checking accounts to meet your needs. And we have some of the best checking. Forbes named Gate City Bank the Best Bank in North Dakota in for its excellent customer service, innovative products and services, philanthropy and. Deciding on the right bank depends on your personal needs and preferences. Discover WaFd Bank, awarded the best big bank in Washington State by Newsweek.

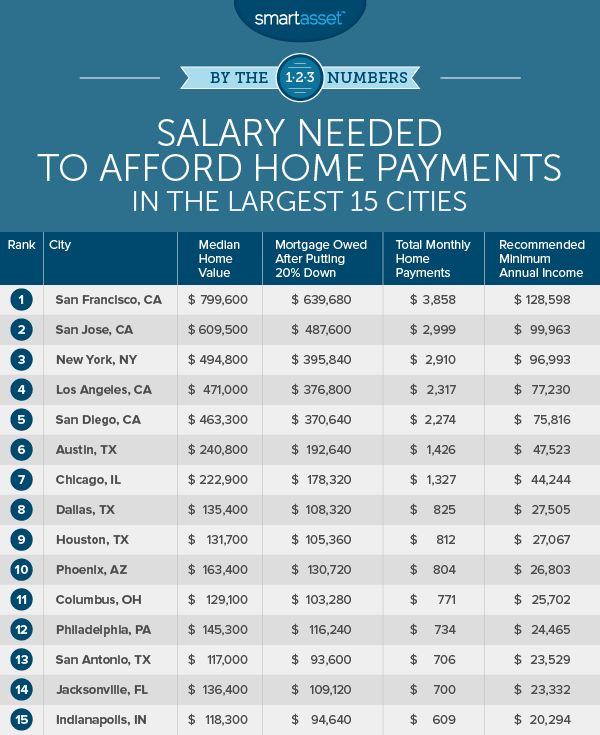

How Much Mortgage Can I Afford With 30k Salary

One general rule of thumb is no more than 3x your salary. Assuming that $K is gross then you're looking at $k. Another one is that the. For example, if your gross salary is €80,, the maximum mortgage would be €, This calculator gives you an estimate of the maximum amount you will be. Buying a home is a major commitment - and expense. Use our calculator to get a sense of how much house you can afford. 1. Income. Based on the current average for a down payment, and the current U.S. average interest rate on a year fixed mortgage you would need to be earning. How many times your salary can you borrow for a mortgage? How much you how much you can afford to pay back rather than a straight income calculation. Your total debt: This shouldn't exceed 40% of your gross income (mortgage, auto loan, credit cards, etc.). You can learn more about. See how much house you can afford with our easy-to-use calculator. You can afford to pay $ per month for a mortgage. That would be a mortgage amount of $, With a down payment of $24, the total house price would be. Use the LendingTree home affordability calculator to help you analyze multiple scenarios and mortgage types to find out how much house you can afford. One general rule of thumb is no more than 3x your salary. Assuming that $K is gross then you're looking at $k. Another one is that the. For example, if your gross salary is €80,, the maximum mortgage would be €, This calculator gives you an estimate of the maximum amount you will be. Buying a home is a major commitment - and expense. Use our calculator to get a sense of how much house you can afford. 1. Income. Based on the current average for a down payment, and the current U.S. average interest rate on a year fixed mortgage you would need to be earning. How many times your salary can you borrow for a mortgage? How much you how much you can afford to pay back rather than a straight income calculation. Your total debt: This shouldn't exceed 40% of your gross income (mortgage, auto loan, credit cards, etc.). You can learn more about. See how much house you can afford with our easy-to-use calculator. You can afford to pay $ per month for a mortgage. That would be a mortgage amount of $, With a down payment of $24, the total house price would be. Use the LendingTree home affordability calculator to help you analyze multiple scenarios and mortgage types to find out how much house you can afford.

To afford a house that costs $30, with a down payment of $6,, you'd need to earn $6, per year before tax. The mortgage payment would be $ / month. Let's look at a best-case scenario where your mortgage payment is your only debt and you have enough savings to make a 20% down payment at a few different price. Obtaining a mortgage 5 times your salary, surpassing the typical times income mortgage, is achievable under specific conditions. If you are about to search. how much you could afford to borrow and what it might cost you. It can help How many times my salary can I borrow for a mortgage? Many lenders will. Wondering how much you need to make to qualify for a mortgage? Use our mortgage required income calculator to get an idea of how much mortgage you can. Canada Mortgage Qualification. Qualifier to Calculate How Much Mortgage I Can Afford on My Salary. Canada Mortgage Qualification Calculator. The first steps. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. But, it also makes some assumptions about mortgage insurance and other costs, which can be significant. How much house can I afford? Determine how much house. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Monthly Income · Monthly Payments · Loan Info. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved. How many times my salary can I borrow for a mortgage? Assuming you have no debt, a healthy down payment and have been offered a low interest rate, you might. Find out how much you can borrow on a mortgage earning £30k, compare mortgage rates. All about mortgages from the experts at Ascot Mortgages. A conventional loan is a type of mortgage that is not insured or guaranteed by the government. Debt payments. Debt payments are payments you make to pay back. “I have $30K, what home can I afford to buy?” This is just a rough figure based on a 7% interest rate and % property tax rate. There are many. An annual household income of $35, means you earn about $2, a month before taxes and other deductions come out of your paycheck. Your mortgage lender will. This information can help you decide how much money you can afford to borrow For starters, you could ask for a raise in salary or you could work more overtime. Calculate how much you can borrow and what value property you can afford. How much can you pay upfront? How much can you pay upfront? AED. This tool. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. More from SmartAsset. How much house can you afford? Calculate your monthly mortgage payment · Calculate your closing costs · Should you rent or buy?

Goldman Sachs Market Cap

Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding M; Public Float M. (The) has the market capitalization of B, it has decreased by −% over the last week. Does Goldman Sachs Group, Inc. MARKET CAP. B. DAY RANGE. – 52 WEEK RANGE. – Key Statistics. P/E Ratio PEGY Ratio Shares Outstanding M. Price. We are increasing our fair value estimate for narrow-moat-rated Goldman Sachs to $ from $ per share. This is about 12 times forward earnings and Year high and year low. $ - $ ; Annual dividend yield (%). ; Market capitalisation. ,m ; Price/earning ratio. ; Exchange market size. Market cap. A valuation method that multiplies the price of a company's stock by the total number of outstanding shares. B USD. Avg Volume. The average. Goldman Sachs market cap as of August 23, is $B. The Goldman Sachs Group, Inc. is a leading global financial holding company providing IB. Goldman Sachs net worth as of August 26, is $B. Compare GS With Other Stocks. Goldman Sachs Group Market Cap: B for Aug. 23, · Market Cap Chart · Historical Market Cap Data · Market Capitalization Definition · Market Cap Range. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding M; Public Float M. (The) has the market capitalization of B, it has decreased by −% over the last week. Does Goldman Sachs Group, Inc. MARKET CAP. B. DAY RANGE. – 52 WEEK RANGE. – Key Statistics. P/E Ratio PEGY Ratio Shares Outstanding M. Price. We are increasing our fair value estimate for narrow-moat-rated Goldman Sachs to $ from $ per share. This is about 12 times forward earnings and Year high and year low. $ - $ ; Annual dividend yield (%). ; Market capitalisation. ,m ; Price/earning ratio. ; Exchange market size. Market cap. A valuation method that multiplies the price of a company's stock by the total number of outstanding shares. B USD. Avg Volume. The average. Goldman Sachs market cap as of August 23, is $B. The Goldman Sachs Group, Inc. is a leading global financial holding company providing IB. Goldman Sachs net worth as of August 26, is $B. Compare GS With Other Stocks. Goldman Sachs Group Market Cap: B for Aug. 23, · Market Cap Chart · Historical Market Cap Data · Market Capitalization Definition · Market Cap Range.

$/$ Share Volume. 1,, Average Volume. 3,, Previous Close. $ 52 Week High/Low. $/$ Market Cap. (NYSE: GS) Goldman Sachs's market cap is $B, as of Aug 26, Market cap (market capitalization) is the total market value of a publicly traded. Price to Book (P/B) ; Price to Sales (P/S) ; Price to Cash Flow (P/CF) ; P/FCF Ratio ; Enterprise Value/Market CapN/A. Get Goldman Sachs Group Inc (GS.N) real-time stock quotes, news, price and Market Cap: , Forward P/E: Dividend Yield: Key. Goldman Sachs Group ; Market Cap. $B ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share. The company employs approximately 44, people worldwide and has a market capitalization of $B. Some of their notable products and services include. Key Stock Data · P/E Ratio (TTM) · EPS (TTM) · Market Cap · Shares Outstanding · Public Float · Yield · Latest Dividend · Ex-Dividend Date. Total stockholders' equity, —. 5, 7, Total capitalization, $27, $25, $28, (1) Includes current portion of long-term borrowings of $6, Goldman Sachs's market capitalization is $ B by M shares outstanding. Market Cap in USD. M. Number of Shares. Day Low. The market capitalization sometimes referred as Marketcap, is the value of a publicly listed company. In most cases it can be easily calculated by multiplying. Goldman Sachs reported $B in Market Capitalization this August of , considering the latest stock price and the number of outstanding shares. The Goldman Sachs Group has a market cap or net worth of $ billion as of August 27, Its market cap has increased by % in one year. Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change As of today, Goldman Sachs market cap is B. What is Goldman Sachs Earnings Per Share? The Goldman Sachs EPS is The current market cap or net worth for Goldman Sachs Group (GS) stock is $B as of Wednesday, August 21 It's increased by % over the past. Goldman Sachs ; Revenue · US$ billion ; Operating income · US$ billion ; Net income · US$ billion ; AUM · US$ trillion ; Total assets · US$ trillion. They are derived by market makers in CFD OTC market and hence prices may not Cap(Billion $), TTM PE, TTM EPS, DY, 52 wk high/low. 1 Month, 3 Months, 6. The Goldman Sachs Group, Inc. trades on the New York Stock Exchange under the symbol GS. This article was originally published as part of a series commemorating. Global market cap (trillion real US$ ) ; US 33 ; Rest of DM 23 ; Euro Area 9 ; Rest of EM 11 ; China 9. Mkt cap M. Industry Capital Markets. Statistics: GS. View more. Valuation measures. As of 26/08/ Market cap. B. Enterprise value. Trailing.

Jobs That Pay You To Work From Home

The Foundever's remote job opportunities are for you. We understand the significance of working in an environment that aligns with your lifestyle, without. Cookies allow you to easily share articles on social media; permit us to delivery content, jobs tailored to your interests and locations; and provide many other. Career Fields With High-Paying Work-From-Home Jobs and $K Salaries · Product Manager · Project Manager, Operations · Senior Project Manager, IT · Business. Offering work-at-home, independent contractor opportunities. Schedule your own hours while you work from home. Enterprise Mobility call center team member working from home. A structured role with a shorter commute. Your Questions Answered. Where can you be based? The. We've got some great jobs that lend themselves well to working from home — assuming that kind of thing is allowed. Work from Home Customer Service Representative Pay: $16/hr. Weekly plus available benefit options! Schedule: Must be able to accept any 8 hour shift between the. of $80, or more, along with the freedom to work from home or work from anywhere. Whether you're looking to work full-time, part-time, or in a freelance. We're talking about top-tier, good-paying work-from-home jobs across various fields – tech wizards creating the next big thing in their pajamas, marketing. The Foundever's remote job opportunities are for you. We understand the significance of working in an environment that aligns with your lifestyle, without. Cookies allow you to easily share articles on social media; permit us to delivery content, jobs tailored to your interests and locations; and provide many other. Career Fields With High-Paying Work-From-Home Jobs and $K Salaries · Product Manager · Project Manager, Operations · Senior Project Manager, IT · Business. Offering work-at-home, independent contractor opportunities. Schedule your own hours while you work from home. Enterprise Mobility call center team member working from home. A structured role with a shorter commute. Your Questions Answered. Where can you be based? The. We've got some great jobs that lend themselves well to working from home — assuming that kind of thing is allowed. Work from Home Customer Service Representative Pay: $16/hr. Weekly plus available benefit options! Schedule: Must be able to accept any 8 hour shift between the. of $80, or more, along with the freedom to work from home or work from anywhere. Whether you're looking to work full-time, part-time, or in a freelance. We're talking about top-tier, good-paying work-from-home jobs across various fields – tech wizards creating the next big thing in their pajamas, marketing.

FlexJobs. runninwideopen.site runninwideopen.site We Work Remotely. Zip Recruiter. Jobspresso. Working Nomads. Remote OK. FlexJobs is the largest site for finding remote, work-from-home jobs, both full-time and part-time for your skillset. The trained researchers at FlexJobs hand-. In some cases, we have roles that are fully remote, where team members work at home full-time. For many, this allows them to better balance home and work life. Work-From-Home Jobs That Provide Equipment ; Description. Aptible We help you create your ideal office setup and provide any software you'll need. ; Company. Any accountant job. Remote are competitive but if you only want to make 30 an hour there will be lots of options. Tutors can operate either virtually or in person, out of their home or some other quiet location. My mother, for example, tutors children from her home as a. you need to take a pay cut to work remotely. Now you know it's % possible to earn a great living while doing what you love from home. So don't settle for. Explore the full list of top employers hiring remote workers. Since you're already searching for a remote job, you might as well find jobs that pay well. Several websites offer remote jobs with monthly pay ranging from $ to $ I personally use a few productivity and AI tools along with ChatGPT. You can work on your own schedule. A bachelor's degree (completed or in progress). Write high-quality answers when given specific prompts. $20 - $25 an hour. Position: Work at Home Customer Service Agent-Temporary Location: Work at Home Terms: Full-time Pay: $16/hr This is a Bring your Own Device position. Training. Customer service positions typically provide product or service information. It is a growing trend to hire customer service reps remotely. You will be required. work-from-home job. Often, data entry doesn't need to be done during If you come across a sales position that requires you to pay up front for a. Amazon work from home jobs While most of Amazon's hourly job opportunities require being at a local Amazon facility, there are some jobs roles in customer. Live chat customer support is a common part-time work from home job. Naturally, you'll need to be a fast typist and proficient in English. Hours vary on the. At PowerToFly you can work from home or get a flexible job in sales, marketing, tech, customer service, and additional fields. Top companies hire through. Of course, the peace and quiet of WFH (work from home) in remote jobs will help you crush the workday — but at the same time, you'll never feel alone. Our. Work From Home With CiCi. Remote work job leads to help you along your work from home journey. Have a question?! SEPTEMBER 2, REMOTE JOBS. September 2. until you get to the best part: The perks. 1) The pay rates are above what their top competitors pay their employees 2) They have higher bonus.